Telegram forex scams are deceptive groups that promise guaranteed profits and exclusive trading signals. In reality, they are designed to exploit traders and steal their money.

In today’s digital trading era, these scams have surged alongside Telegram’s explosive growth, making it essential for every forex trader to know the red flags and protective measures.

The Dark Side of Telegram’s Trading Revolution

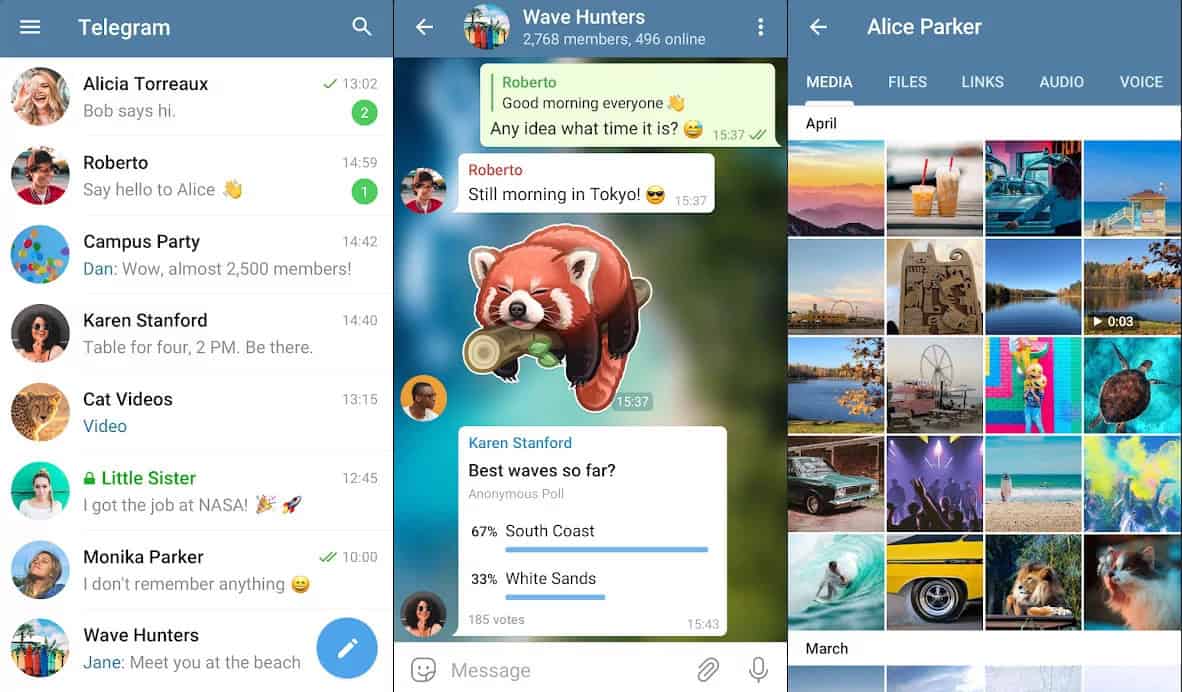

With over 800 million active users and more than 500,000 forex-related channels, Telegram has evolved into both a hub for innovative trading ideas and a playground for fraudsters.

In 2024, the Federal Trade Commission reported a dramatic 65% increase in complaints regarding Telegram trading scams, with losses topping $200 million.

These scams lure traders with promises of “risk-free riches,” only to deliver significant financial and emotional harm.

Why Telegram Is a Perfect Storm for Scammers

Telegram’s unique features create an ideal environment for fraudsters. Here’s why scammers thrive on this platform:

- Encryption & Anonymity: End-to-end encryption helps scammers operate without detection.

- Global Reach: A single channel can instantly broadcast to over 200,000 members, breaking down geographical barriers.

- Bots & Automation: Sophisticated bots simulate human interaction, sending fake trading signals around the clock.

The Psychology Behind Signal Groups

Scammers manipulate traders by exploiting emotional triggers:

- Fear of Missing Out (FOMO): Bold claims like “Join now or miss the next 1,000-pip trade!” prey on your desire not to be left behind.

- Illusion of Expertise: Fake “master traders” pepper their messages with technical terms such as “Fibonacci retracements” to appear credible.

- Social Proof Manipulation: Fabricated testimonials, such as “I turned $500 into $10k overnight!” lure in even the cautious.

Inside a Fake Signal Group

Fraudulent signal groups operate in three distinct phases, each carefully crafted to hook you and empty your wallet.

The Hook

- Free Signals: They often dangle the promise of “10 free signals” boasting unrealistic win rates (think 90% accuracy).

- Fake Proof: Expect doctored screenshots of miraculous profits—often manipulated using software like Photoshop or TradingView’s replay mode.

- Celebrity Impersonation: Deepfake videos of respected figures, even mimicking icons like Warren Buffett, may be used to build credibility.

The Bait

- Premium Tiers: Once hooked, you’re upsold on “Gold” or “VIP” memberships (prices ranging from $299 to $999 per month) with promises of “exclusive strategies.”

- Fake Urgency: Phrases like “Only 5 spots left—price doubles tomorrow!” are common pressure tactics.

- Affiliate Schemes: You might even be enticed to recruit friends, forming a pyramid-like structure that benefits the scammers.

The Exit

- Signal Sabotage: Deliberate losing trades are sometimes executed, with the scammer blaming “market volatility” while pushing you to invest more.

- Ghosting: Eventually, the channel vanishes or the admins disappear, often reappearing later under a different name.

Recognizing the Red Flags

Spotting a scam early can save you from devastating losses. Here are the most common red flags:

Obvious Warning Signs

- Guaranteed Profits: Claims like “Never lose a trade with our AI algorithm!” are unrealistic—no legitimate trader can promise wins.

- No Verifiable Track Record: Be cautious if they refuse to share verified trading performance via platforms such as Myfxbook.

- Anonymous Admins: Profiles with generic stock photos and no personal details are a huge red flag.

Subtle Clues

- Overuse of Jargon: Excessive technical terms, such as “institutional liquidity,” might be used to mask a lack of real expertise.

- Inconsistent Time Zones: Receiving signals at odd hours (like 3 AM GMT for a major pair such as EUR/USD) can be suspicious.

- Copy-Pasted Analysis: Identical “market insights” recycled across multiple groups indicate a lack of genuine analysis.

Quick Checklist to Spot Scams:

- Does the group pressure you to act immediately?

- Are there spelling or grammar errors in what’s presented as professional analysis?

- Do the signals omit crucial details like entry, exit, or stop-loss levels?

Real-Life Scenarios from Victims

Hearing from others can be a powerful reminder of the risks involved:

- A Costly Catastrophe: One trader from the USA, lured by promises of “bank-level strategies,” deposited $250,000 into an “Elite Forex Signals” group—only to lose 95% of the investment in a matter of weeks. The channel soon vanished, leaving her with mounting losses and a looming margin call.

- The Fake Hedge Fund: Another group, calling itself “Alpha Capital FX,” claimed ties to a prestigious Swiss hedge fund and even showcased forged SEC filings. After collecting around $2 million from members, the administrators disappeared, with traces leading back to a basement in Romania.

- Community Outcry: On popular forums like Forex Peace Army, over 80% of participants have reported falling victim to Telegram scams, describing them as “digital pickpockets—slick, ruthless, and invisible.”

The Ripple Effects of Fraud

The consequences of these scams stretch far beyond your trading account:

- Financial Devastation: On average, each victim loses about $12,000. For many, especially those over 50, these losses have wiped out entire retirement savings.

- Psychological Warfare: Many victims experience long-lasting anxiety, depression, and even severe relationship strains—some have shared that personal losses have deeply impacted their families.

- Market Erosion: Widespread fraud has led to growing distrust in legitimate signal groups and has spurred regulatory bodies to impose stricter rules on retail trading platforms.

How to Protect Yourself

Empower yourself with these tactical tips to steer clear of scams:

Verification Protocols

- Check Track Records: Always ask for a verified Myfxbook history (ideally, a minimum of six months) before considering any paid signals.

- Regulatory Checks: Look up the provider’s name on official registers like FCA or ASIC .

- Reverse Image Search: Use tools like Google Lens to verify that the “success story” images haven’t been stolen from elsewhere.

Signal Testing Strategy

- Demo Account Trials: Test any signals for 30–60 days on demo accounts using platforms such as MetaTrader 4.

- Third-Party Audits: Utilize independent tools like FX Blue to verify performance data.

Behavioral Safeguards

- Ignore Hype: Be wary of groups that overuse ALL CAPS or emoji-filled messages.

- Limit Exposure: Never risk more than 1% of your capital on any single trade signal.

- Community Vigilance: Join communities like r/ForexScams on Reddit or visit dedicated forums such as Scamwatchers.org to share your experiences.

Reporting Scams and Seeking Justice

When you encounter a scam, prompt reporting is key:

Reporting on Telegram

- How to Report: Open the suspect channel, click on “Report,” select “Scam,” and add any relevant details. You can also forward scam messages to community watchdog bots like @NotAScamBot.

Reporting to Regulators and Law Enforcement

- Regulatory Bodies:

- Law Enforcement:

- File a police report if your losses exceed $10,000.

- For cybercrime issues, report to IC3.

Legal Remedies

- Chargebacks: If you used a credit card, request a chargeback for the fraudulent transaction.

- Cryptocurrency Tracing: Victims using crypto should have their wallets traced via tools like Chainalysis and report the findings to the respective exchanges.

- Class Actions & Private Attorneys: Consider joining group lawsuits or seeking specialized legal help for cross-border fraud cases.

Future Trends in Scam Tactics

Scammers are constantly evolving their methods. Here’s what to watch for:

Emerging Threats

- AI-Generated Signals: Bots leveraging advanced AI (like ChatGPT) may soon produce fake “fundamental analysis.”

- Synthetic Voice Scams: Scammers might clone the voices of high-profile figures, even mimicking celebrities such as Elon Musk.

- NFT Integration: Beware of scams selling “exclusive trading NFTs” that hold no real value.

Countermeasures on the Horizon

- Platform Upgrades: Telegram is testing AI-powered scam detection and considering mandatory KYC for larger channels.

- Regulatory Innovations: New tech, such as EU-wide digital identity verification (eIDAS 2.0), is emerging to hold financial influencers accountable.

- Educational Initiatives: Look out for free webinars from regulatory bodies like the CFTC that aim to teach traders how to spot scams in mere seconds.

Your Shield Against Telegram Scams

Staying safe in the trading world requires vigilance and a proactive mindset. Here are the key takeaways:

- No Free Lunches: If someone claims 90% accuracy on signals, remember—if it were that reliable, they’d be trading their own money.

- Trust, but Verify: Legitimate groups welcome scrutiny. Scammers, on the other hand, are quick to vanish when challenged.

- Community Defense: Share scam alerts and educate fellow traders to create a network of informed, cautious investors.

What to do next:

- Report: Always report suspicious groups to help protect others.

- Educate: Share this guide with your trading peers on social media.

- Support: Consider donating to nonprofits like SCARS that aid scam victims.

Additional Resources

For further reading and verification, explore these trusted resources:

- Verification Tools:

- Regulatory Agencies:

- Support Networks:

- Educational Content:

- YouTube

Stay vigilant, trade smart, and always verify before you invest. Remember, in the world of digital deception, skepticism is your best defense. This guide is for educational purposes only and should not be considered financial advice—trade at your own risk.

For a deep dive into spotting and avoiding scams, explore our comprehensive guide: How to Avoid Forex Broker Scams: The Ultimate Safety Guide (2025)